Using a 300-square-foot shipping container-like structure as its base, California property development and hospitality company Caruso turned a walkway in its flagship property into a lucrative pop-up shop back in 2016. Now, it hopes to recreate its success in its other properties.

Named “The Glass Box,” the space is a blank canvas for brands to design, build and occupy for one month at a time at L.A.’s The Grove outdoor mall. Over the past few years, The Glass Box has brought in millions in revenue for Caruso by housing brands like Skims, Saie, Outdoor Voices, Sézane, Beautycounter, Hourglass, Everlane and Glow Recipe.

“We are essentially booked up for the next 24 months,” Jackie Levy, chief financial and revenue officer at Caruso, told Glossy about The Glass House. “The interest that we’ve gotten is incredible. It’s just such a great venue for digitally-native brands to test their concept in a brick-and-mortar [environment].”

Los Angeles has several high-end shopping centers within just a few miles of The Grove, but none have a pop-up program as popular, discussed or in-demand. By most accounts, The Grove is one of the city’s top shopping and entertainment destinations because it holds a special reverence for shoppers. It’s meticulously clean and well-staffed and there are near-constant free activations like concerts, brand events and holiday offerings. In December, Caruso uses ski resort-like machines to make it snow.

That it often reminds shoppers of Disneyland’s Main Street isn’t a coincidence. According to the L.A. Times, Caruso personally selected the flowers planted on the property and hired a former Disney “Imagineer,” or engineer, to design the trolley on tracks that glides down the main shopping corridor.

The Grove sees 20 million annual visitors with 90,000 visitors per day in peak times, a quarter of which are tourists, according to a Caruso sales deck attained by Glossy. Ironically, that’s more than Disneyland, which saw 16.88 million parkgoers in 2022, according to Statista.

“We don’t consider ourselves to be in the development business; we consider ourselves to be in the hospitality business,” Caruso’s Levy told Glossy. “We’re not a mall. We’re an outdoor shopping center that doesn’t have a million square feet of leasable area, so we’re space constrained, which we look at as a good thing because it allows us to be very curated.”

The 545,000-square-foot retail center contains 50 retail doors that house Nordstrom, Nike, Apple, Barnes & Noble, Aritzia and Sephora, among other retailers, plus restaurants.

Caruso declined to share the price for the standard month-long takeover of The Glass House, but sources told Glossy that, in the past 12 months, they were offered the space for around $65,000 flat, plus a $10,000 security deposit, not including buildout. This is up from $30,000, which one brand paid for the space near the pop-up’s launch eight years ago — they preferred to remain anonymous. Caruso’s Levy told Glossy he’s seen buildouts range from $15,000-$100,000. Caruso provides a list of preferred vendors, but brands aren’t required to use them.

Caruso’s pop-up program is run by an in-house pop-up team that also sells kiosk space and one-day pop-up placements. Kylie Cosmetics, Jenni Kayne, Peach and Lily, Coach, and Dior have all popped up for shorter windows with Airstreams, vans and other creative spaces on wheels.

To be considered, brands must submit their full pop-up strategy including the buildout blueprints, activation schedule, intentions for the partnership and social followings, Levy said.

The Glass Box also serves as an audition for retailers hungry to enter a Caruso property. “There’s a long-standing track record of exceptional [sales] results that have transitioned into [more] great results in permanent stores,” said Levy. “Byredo, as a result of their performance in [The Glass Box], opened up a store not only at The Grove, but at [other Caruso properties including] Palisades Village and The Americana at Brand.”

Diptyque, Lululemon, Charlotte Tilbury and Ray-Ban also propelled successful pop-ups into permanent stores at The Grove.

“It’s very intentional that we use The Glass Box as an incubator for the retailer to test out our property and see how they would perform, and for us to see how the community embraces the product and the brand,” said Caruso’s Levy. The Grove is currently at full occupancy.

The Glass Box began as an experiment for digitally-native brands seeking to test their customers’ appetite for shopping the brand IRL. Its first tenants included Schutz, M.Gemi, Obsesee and Chiara Ferragni, but it has also attracted luxury brands. In 2018, Tiffany & Co. hosted the brand’s first-ever pop-up in the Glass Box, and the space is currently being occupied by D&G Beauty.

The brand pop-ups must be open during The Grove’s operational hours of 10 a.m. to 9 p.m. They’re promoted by Caruso through the company’s loyalty program and social media channels, as well as signage throughout the property.

“I love the idea of customers being able to touch and feel [the products] in an environment with so much traffic,” said Kate Weizman, chief marketing and digital officer of Westman Atelier, which popped up in The Glass Box in April of 2023. “The two things I was the happiest about hearing [during the pop-up were], ‘Oh, I’ve never heard about this brand before. Tell me about it,’ and, ‘I’ve seen you on TikTok and I’ve always wanted to try your product, but I never have.’”

This is despite the fact that Westman Atelier is already sold in two retailers at The Grove — Sephora and Nordstrom. According to Weizman, those retailers were thrilled to see the brand in the pop-up.

Westman Atelier utilized its design and marketing teams to plan and run the pop-up internally, but brands can also partner with a current retailer, like Nordstrom or Sephora, to handle all store operations.

“We loved partnering with Sephora to bring the pop-up to life,” said Tara Simon, global brand president of Too Faced, which popped up in The Glass House in April of 2022. “They were our partners in every which way, from promotion to execution, point of sale and staffing.” At the time of this story’s publication, Sephora had not shared the requested details on how brands can partner with the retailer in The Glass Box.

One brand that popped up in a smaller space at another Caruso property, but didn’t want to be named in this article, said the brand experienced a halo effect at a retailer in the center on the same day.

This is common, Glossy has learned, but for many brands, sales aren’t a top priority for their pop-up.

“We had a press goal, an impression goal and a [customer acquisition] data goal,” Westman Atelier’s Weizman said. “We did have daily revenue goals, as well, but our main KPI was definitely brand awareness.”

This was Westman Atelier’s first standalone pop-up and coincided with its entry into skin care. Booking and planning took six months. Top sellers at the pop-up were the brand’s Baby Cheeks blush ($48), Face Trace Contour Stick ($48), Vital Skin Foundation Stick ($68) and Skin Activator ($150).

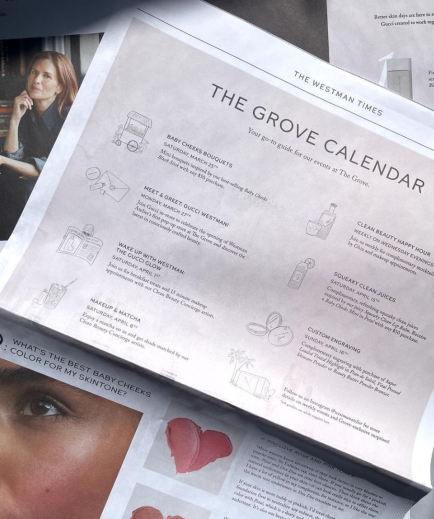

To maximize the time and space, Weizman staffed the pop-up with makeup artists and planned three events per week, which regularly spilled onto the sidewalk and grassy lawn behind the building, which Caruso encourages. The events were promoted through email and social media and outlined in a special Westman Atelier newspaper created by the marketing team and distributed around the property. “The community and VIP events were really important to us in order to drive the traffic and revenue that we needed, and those were our best performing days,” Weizman said.

These included a “clean beauty happy hour,” where the brand partnered with Ghia non-alcoholic aperitif. There were also VIP events where the brand’s top e-commerce shoppers based in L.A. were invited for evening shopping, bites, drinks and free product engraving. Community events centered on flower bouquet making, a matcha latte bar, fresh juice or vegan pastries, and each tied to a product or brand value. To participate in the free activities, Westman required potential customers to first interact with the products. “To get a matcha, you had to get shade-matched,” Weizman said.

In the past, The Glass Box tenants have used The Grove’s extra space differently. In 2017, Rebecca Minkoff took over the entire shopping center during its residency to host the brand’s spring 2017 runway show along the center’s trolley tracks. The same year, Charlotte Tilbury hosted a circus-themed party on the lawn, and Outdoor Voices used it for large group yoga classes.

Each day during Westman Atelier’s four-week residency, makeup artists walked The Grove with iPads trading Westman Atelier samples for emails. Sales were also done through the iPad. “We welcomed thousands of customers into our funnel,” Weizman told Glossy. “I, personally, was pleasantly surprised at how strong our revenue was. … And our AOV at The Grove was actually higher than our website.”

Too Faced also approached the opportunity as brand marketing, not a revenue driver. And its choice store design reflected the brand’s goals. “[We made an] immersive, bakeshop-inspired space that showcased our sensorial products. It was a great way to share the playful side of the brand,” said Too Faced’s Simon. “Design and production of the shop took a couple of months, but the actual buildout on site took under 48 hours.”

Based the success of the program, Caruso is planning to mimic it starting this summer. “We’re looking at Palisades, Americana and also Miramar [Resort in Montecito] as potential venues to roll this out,” Caruso’s Levy said. “We also want to serve as an incubator to get more diverse businesses into The Glass Box down the road.”

Caruso is privately held and built The Grove in 2002 for $160 million, according to the Los Angeles Business Journal. The company currently owns and operates 17 properties in Southern California, which include shopping centers, luxury retail-apartment hybrid properties and a resort in the wealthy Central Coast town of Montecito, which has a Goop and James Perse store on site.

The Grove’s success inspired Caruso to open similar outdoor malls in L.A.: The Americana at Brand and Palisades Village, which opened in 2008 and 2018, respectively.

Owner Rick Caruso’s name is well-known in Los Angeles. He was Commissioner for the L.A. Department of Water and Power, then President of the L.A. Police Commission before he began developing properties. He’s served on the board of many organizations, like USC and St. John’s Hospital. In 2022, he unsuccessfully ran for L.A. mayor.

But Caruso is just one developer drawing digitally-native brands with a pop-up space. In 2019, Good American tested brick-and-mortar retail with a holiday pop-up in the Triple Five Group-owned Mall of America in Minneapolis. It now has three U.S. brick-and-mortar locations across Southern California and Las Vegas.

Cost and product assortment is often the biggest deterrent for brands seeking retail exposure in small pop-up spaces. In speaking with brands, Glossy has learned that small, non-sized items tend to sell best, including fragrance, makeup, candles, skin care and accessories, like jewelry and sunglasses.

A person who has inquired about The Glass Box for a brand client told Glossy that brands can spend more than $250,000 out the door, once events, staffing and sampling are added. Another source told Glossy that her marketing team estimated that it would take $500,000 to pull off a pop-up the way the brand had envisioned. Neither pursued the space further.

One founder of a brand that popped up in The Glass Box in the past 24 months, but preferred not to be named in this article, said it was an amazing experience for brand marketing, but sales were low. They, and the other brand executives interviewed for this story, declined to share details on sales driven through the pop-up space.

“A pop-up is a great way to get your foot into traditional retail and it can really propel a brand,” said Anita Gatto, a marketer who has done pop-up creative for Kylie Cosmetics and pop-up strategy for popular L.A. centers like Westfield Century City mall and The Beverly Center. “You do get a lot of data and market testing, but only a small amount of brands can have a strong ROI if they’re space constrained [and they’re not selling the right category].”

Caruso’s Levy told Glossy that results are analyzed in a few ways at Caruso. “It’s a matter of looking at the data and the sales that are coming out of the store, but it’s also talking to the store [leaders] to make sure that their objectives were met, in terms of building awareness for their brand and ultimately sales,” he said. “So it’s a little bit of both: art and science.”